Finnvera secures Finnish exports – country monitoring provides crucial information about market risks

By Tiina Riippa at Finnvera Oyj

Finnvera’s mission is to safeguard the competitiveness of Finnish enterprises in export markets by offering them export and project financing at rates comparable to those offered by Finland’s main competitor countries. For its part, financing arrangements enable the success of Finnish companies in international competition.

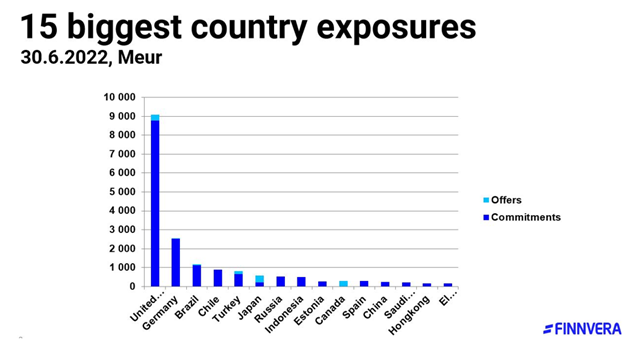

Finnvera has export credit guarantee and special guarantee exposures in more than 90 countries. This definitely shows the versatility of Finnish exports. Finnvera’s 15 largest countries of exposure in June 2022 were the United States, Germany, Brazil, Chile, Türkiye, Japan, Russia, Indonesia, Estonia, Canada, Spain, China, Saudi Arabia, Hong Kong and El Salvador.

To which countries and under what conditions export financing can be arranged, that is defined by Finnvera's country policy and country classifications.

The countries of the world are classified into eight categories depending on their ability to manage their external liabilities, their political stability and legislative framework, and their economic outlook. The country risk classification is based on methods widely used by export credit agencies as well as payment experiences, according to which the countries are classified together in the OECD. The country categories affect the level of guarantee premiums and the required countersecurity or payment terms.

”Finnvera’s risk-taking is based on our country-specific guarantee policy, as considerable differences may exist between countries even if they are classified in the same category. For example, India and Uruguay are both in country risk category 3 – yet, in terms of country risk, Uruguay is a simple, easy operating environment, while India is a complicated operating environment. We monitor the countries’ economic and political situations, and review the category of each country is at least once a year”, says Head of Team Eeva-Maija Pietikäinen at Finnvera.

Finnvera has four Senior Advisers as regional managers who monitor the development of different countries and markets from the export financing’s point of view. In this sense, the world is not ready, but in constant change in both positive and negative directions. For example, trade to one of Finland's most important export destinations, Russia, completely stopped as a result of the war started by Russia and the following sanctions.

On the other hand, the country classifications of Guyana and Aruba in Latin America and the Caribbean were recently improved at the OECD country classification meeting held together with Finnvera’s peer guarantee institutions.

”Country monitoring is needed, for the markets are constantly changing. As regional managers, we assess market development, economic stability and the probability of political risks so that Finnvera can finance exports, i.e. grant export credit guarantees to exporters to important countries. We operate in the whole world, and when talking about exotic markets in Finnish terms, it is important to recognise the possible risks and opportunities of that operating environment”, says Finnvera’s Senior Adviser Mika Relander.

How to manage political and commercial risks

Finnvera's export credit guarantees to protect exporters and banks financing exports against political and commercial risks. Political risks are related either to the home country of the foreign buyer or borrower or to a third country, where the political situation can cause the exporter, investor or lender to incur a credit loss. Commercial risks arise from foreign banks, companies or project companies.

In export financing Finnvera follows the principle of sustainable development in compliance with the Act on the State’s Export Credit Guarantees and complies with internationally accepted principles and procedures for assessing environmental and social impacts. By managing environmental, social and governance risks, we ensure the accountability and risk management of our financing operations.

Finnvera’s advisors can be found on the country risk classification map

Country categories and contact details of the regional managers for different markets can be found on the country risk classification map at Finnvera.fi.

Emails format is firstname.lastname@finnvera.fi.

Our regional managers and countries:

Outi Homanen

Southern Africa

Middle and West Africa

Russia, Ukraine, Belarus

Jere Nieminen

South Asia (i.a. India)

Middle East

North Africa

Mika Relander

Latin America and Caribbean

North America

East Asia (i.a. China)

East Africa (i.a. Kenya and Tanzania)

Liisa Tolvanen

Europe (i.a. Türkiye)

Central Asia (i.a. Kazakhstan and Uzbekistan)

Kaukasia (i.a. Azerbaijan)

South East Asia (i.a. Indonesia)

Oceania (i.a. Australia and New Zealand)

The finance managers responsible for bank risks at Finnvera are:

Lea Lintunen

Africa

Middle East (i.a. Türkiye)

North America

Anja Pakkala

Asia

Latin America

Caribbean

Europe