Finnish Economic Outlook, June 2024: Awaiting Recovery

Written by Jukka Appelqvist, Chief Economist, Finland Chamber of Commerce (Keskuskauppakamari)

The difficult economic year of 2023 ended in a recession. On annual level, Finland's GDP contracted by 1.2%. Among the 27 EU countries, Finland's economic growth was the fourth weakest. So far, we have seen only modest improvement in the first half of 2024. It appears that Finland's economy remains at the bottom of the business cycle, with growth still on hold. However, there are underlining hopeful signs indicating that several fundamental drivers for the economy are gradually improving. Growth will be sluggish at first, but it is likely to gather momentum towards the end of the year. There is a good chance that we will see substantial economic recovery in Finland in 2025.

Sentiment among Finnish companies was still quite pessimistic in the May survey of Finland Chamber of Commerce. Expectations regarding turnover and profitability improved slightly from January, but so far, we are yet to see a clear shift in the weak near-term outlook. For the most part, the beginning of 2024 has been difficult, with a significant number of respondents reporting decreased turnover compared to the previous year. Strikes have likely contributed to the situation. Also, the order-books for manufacturing industries remain thin.

Compared to the previous year, turnover decreased for 38.4% of respondents in the May survey, while 28.9% reported an increase. Also, growth expectations remain modest, but gradual improvement is visible. Almost 29% of respondents expect their turnover to increase in the next six months, compared to 26% in January and just over 24% in October. Unlike in the previous two surveys, the share of respondents expecting turnover growth was higher than those anticipating a decline.

Despite significant differences between sectors, sentiments are converging. The construction sector remains the bleakest, but extreme pessimism has lessened in construction. Conversely, the outlook in the traditionally most optimistic service sector is on a downward trend. For services, prospects are dampened by rising unemployment, still weak household purchasing power, and upcoming VAT increases. However, the situation is not hopeless. Services will benefit from rising real wages, which will be a one of the domestic drivers for recovery in Finland.

Figure 1. Expectations for Revenue Growth Over the Next 6 Months

Order books remained depressed for many respondents in the May survey, with no significant improvement from January. Compared to the previous year, 43% of respondents reported smaller order books and 35% saw them unchanged. Less than 22% said that their situation has improved. While there were no massive expectations for improvement yet, the situation is relatively balanced. Over the next six months, 24.4% anticipate further reductions in order books, a slightly lower figure than in January and significantly lower than in October when 34.3% expected a decrease. In the May survey, 25.3% of respondents expected growth in their order books. The rest anticipated no change, which could prolong challenges for some companies.

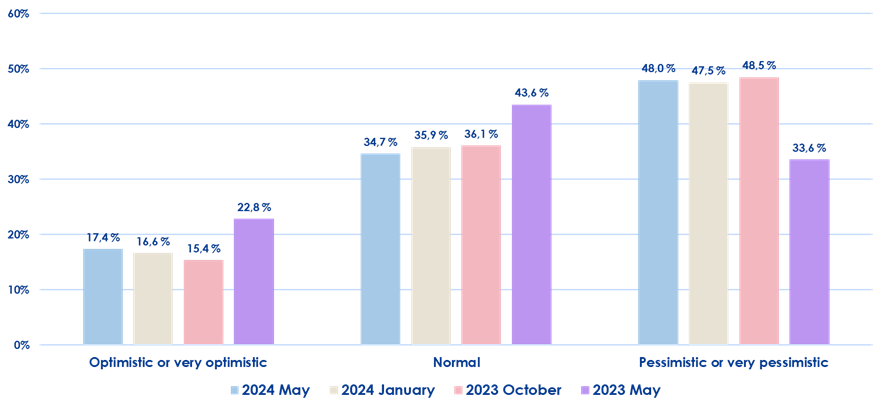

Figure 2. Current overall sentiment in your industry

Profitability expectations were more positive in the May survey than before. The situation remains challenging, and more respondents still expect profitability to decline rather than improve. In the next six months, 36% expect profitability to worsen, while 26.5% anticipate improvement. Despite seemingly poor numbers, the situation is better than in October when 41.4% foresaw a decline. Expected profitability has improved across all sectors except services.

Light at the End of the Tunnel

Excessive pessimism should be avoided, as it is likely that several headwinds are gradually receding and turning into tailwinds. One of the biggest cyclical hurdles for Finland has been euro area's monetary policy, which is currently clearly too tight for the Finnish economy. High interest rates have caused difficulties for both households and businesses. However, relief is on the horizon. ECB’s monetary policy will not change as quickly as anticipated at the beginning of the year, but the direction remains clear. Interest rates will decrease in the future, although it would be desirable from Finland’s perspective that the pace be quicker.

Regarding exports demand, there is also reason to expect improvement. Demand has been weak in the early part of the year, but there are signs of change. Globally, manufacturing has already recovered moderately, and it is likely that the euro area will soon follow.

In addition to interest rates and export demand, the third key positive driver for the economy will be household consumption demand. Currently, declining employment is hampering the much-awaited consumption-driven growth, but on average real wages are improving after a long difficult period. Going forward, inflation is expected to continue to subside, and as nominal wages to continue to rise, domestic consumption demand will gradually become the third support pillar of recovery.

In sum, the prospects for growth remain weak for the time being, but the economic cycle is likely turning for the better. On a global scale, this has already happened to some extent, and for Finland, there is reason to expect a clear improvement towards the end of the year. Recovery is likely to gather momentum in 2025. Since several key economic growth factors are expected to strengthen, one might even wonder whether businesses remain overly pessimistic at the moment.

Jukka Appelqvist

Chief Economist at the Finland Chamber of Commerce (Keskuskauppakamari)

044 263 1051

jukka.appelqvist@chamber.fi